What’s it all about?

Two techniques for dealing with the cost of overheads when setting prices, valuing stock and calculating profits.

Why have we got two different approaches?

Marginal costing –

“Factory Overheads do not change with production, therefore they are not part of the cost of production, so they do not need to be considered as part of the cost of the product. You will incur the overheads regardless of the amount of production; you will have the same bill even if you don’t make anything, so it’s nothing to do with what you make.”

Absorption costing –

“Factory Overheads need to be incurred otherwise you could not make any product, therefore they must be considered as part of the cost of production. If you don’t have somewhere to do the work, you won’t be able to do any work, so the factory is essential to be able to make things. That means that cost must be shared across what you make. And, if you ignore them, as you do under marginal costing, then they will be uncontrolled and escalate, so absorbing them into the cost of product is the best way to keep an eye on them.”

Both methods are right of course, but they give very different results.

Spot the difference?

Identify the differences between the two sets of accounts.

They are for the same business, for the same time period and both calculations are correct. The company made the 6,000 units they planned to make and sold 6,000 of them.

Loading...

Loading...

Several questions come to mind.

Why do we get these differences when it is the same actual business and performance? ….. What can you find out from the above figures? ….. Which is the right way to do this calculation? ….. What is the selling price of a unit? ….. What is the variable cost of production? ….. What is the fixed costs absorbed per unit? ….. Which profit is best?

It comes down to two things, 1) the different treatment of Factory Overhead (budgeted rate absorbed per unit versus Actual Factory overhead for the period) and 2) the impact that this has through changing stock levels.

‘Translating’ between the two is one of the hardest things people do if they use the traditionally taught methods, but I’ll teach you The Rooks’ Method and you’ll find it easy.

Firstly we need to explain what is going on then we will deal with numerical answers.

When we looked at dealing with overheads, we saw there were three categories:

Factory—the indirect costs of the place where we make our product.

Sales & Distribution—the indirect costs of getting customers and products to them.

Administration—the costs of running the business as a whole.

We are interested in the Factory Overhead when we are doing Absorption Costing.

The Factory Overhead is part of the cost of the unit when we do Absorption Costing, Sales & Distribution and Administrative Overheads are taken from the Gross Profit to give Net Profit.

We are not interested in any of the Overheads when we are doing Marginal Costing.

The Factory Overhead is not part of the cost of the unit. Just like Sales & Distribution and Administrative Overheads it is taken from the Gross Profit (strictly speaking it is the Contribution) to give Net Profit.

We still pay all the bills, it is just that the Factory Overheads are deducted from the income in a different manner.

Look at the differences in position and wording for the line for Factory Overheads in the layout below.

Absorption v Marginal Layout

| Absorption Costing | Marginal Costing | |

|---|---|---|

| Sales | Sales | |

| Direct Materials | Direct Materials | |

| Direct Labour | Direct Labour | |

| Direct Expenses | Direct Expenses | |

| FACTORY OVERHEAD ABSORBED | ||

| Gross Profit | Contribution | |

| ACTUAL FACTORY OVERHEAD | ||

| Budgeted Sales & Distribution Overhead | Actual Sales & Distribution Overhead |

|

| Budgeted Administration Overhead | Actual Administration Overhead |

|

| Net Profit | Net Profit |

The calculation is affected by using the budgeted absorption rate x units sold being used in Absorption Costing, while in Marginal Costing we use the actual total Factory Overhead for the period.

That difference causes everything.

Worked examples

The green text means this pdf has audio. You need to download it to Livescribe at the url in the document to get it to work. It’s worth it. If it doesn’t immediately work, try another browser.

So what is going on.

Read these notes and revisit the calculation above, or one of the others, to see how each step has been done.

- We recognise that stock has a different cost in each method (Absorption Costing values stock at Variable cost plus a share of the overhead – Marginal Costing values stock at just its Variable cost.

We calculate the amount of overhead added under Absorption Costing by this calculation.

Budgeted Overhead/Budgeted Production*.

We have to use the Budgeted figures as we won’t know the Actual costs and production until the end of the year and it is too late then to ask customers for extra payment to cover the overheads.

* Our measure of Budgeted Production could be units, or Labour Hours or Machine Hours or whatever other method we are using. But, for simplicity, we will usually use units to make the questions easier to follow.

Think of Absorption Costing being like a bathroom sponge that sucks up the Factory Overhead in the same way that a sponge absorbs water.

“Gelber Putzschwamm” by marcoverch is licensed with CC BY 2.0.

2. We look at the movement of stock in and out of our ‘cupboard’.

That’s because when we don’t sell the same number of units as we have made, there will be a difference in the profits of the two costing systems.

However, if we sell exactly the same number as we make, then the profits will be the same.

If we put one unit into store, then under Absorption Costing we are recording it in the store at the value of its Variable cost plus its allocated Factory Overhead. But, if we said that one unit was put into the store using Marginal Costing, then it would only have the value of its Variable cost.

This has two impacts. Firstly the value of the units in store (in the cupboard) under Absorption Costing is higher and secondly (more importantly) that unit’s overhead cost hasn’t been charged against our income, so our profit will be higher.

This really matters because, under Marginal Costing, we have charge all the Factory Overheads in total against the sales.

So, under Absorption Costing, when we sell fewer than we made, we will put units in the cupboard and they will take their share of the Factory Overhead with them. There will be lower overheads charged compared to Marginal Costing and Absorption Costing will have a higher profit.

If, under Absorption Costing, we sell more than we made then Marginal Costing will have a higher profit. That’s because the units taken out of the cupboard (the ones we need to complete the total sales) each bring with them their overhead which is now charged against the sales. Under Marginal Costing we will charge the full Factory Overhead, as always, but it will be less than the full Factory Overhead + the overhead on the stuff taken out of the cupboard.

It is a waste of time in my view to worry about actual stock levels in considering this point. It doesn’t matter how many were in the cupboard and how many are left. There must have been enough, or we wouldn’t have been able to sell them.

The only thing that matters is how many units the stock level has gone up or down. We multiply the change in units x overhead absorbed to get the total cost under Absorption Costing.

If we have put units into the store, this £ number will be the difference in profits with Absorption being higher.

If we have taken units out of the store, this £ number will be the difference in profits with Marginal being higher.

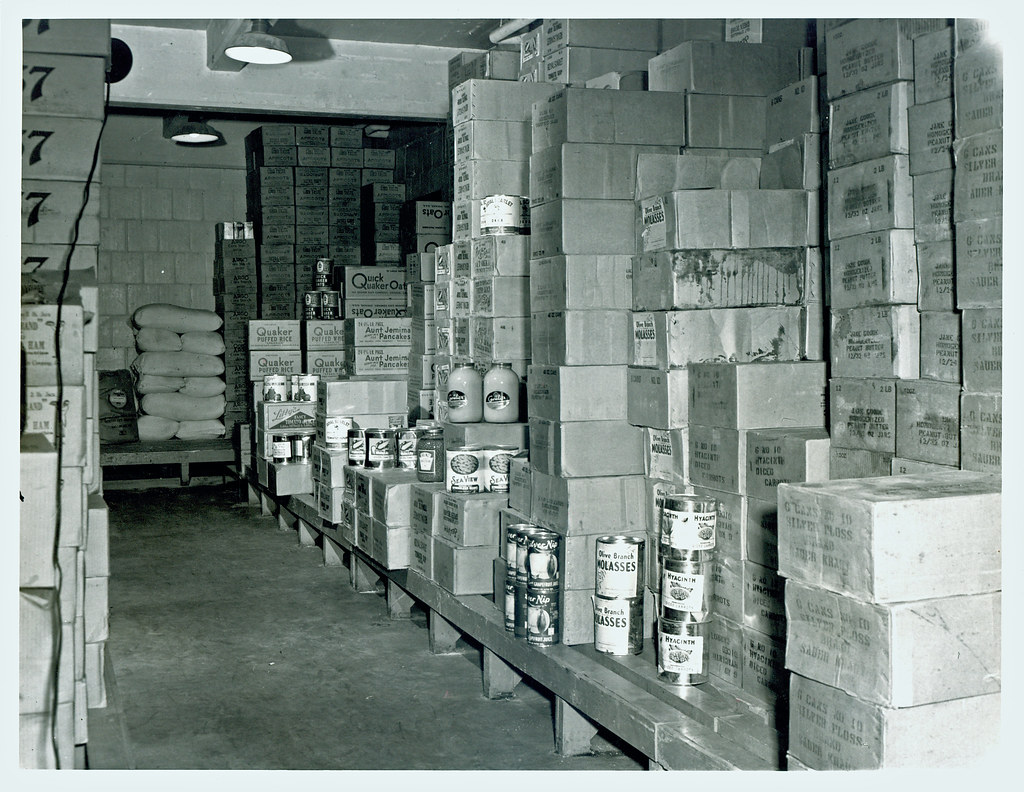

“Storeroom, 1946” by Duke University Archives is licensed with CC BY-NC-SA 2.0.

3. Calculating the Marginal Profit.

We do this one first because it is easier. The two things you have to remember are to only use Variable Cost as the Cost of Sales and to charge the Actual Factory Overhead, not a Budgeted Factory Overhead. The importance of this point becomes clearer at the end.

Familiarise yourself with the layout of the schedule.

For most questions, to keep it straightforward, you will usually find that the Administration Overhead and Sales & Distribution Overhead are given as budgeted numbers and you won’t normally be given the Actual figures. It makes the questions less complex. In reality, you will use the Actual figures for these two overheads recorded at the end of the period.

4. Predicting the Absorption Costing Profit.

Because we did a calculation with the stock movement we know whether Absorption or Marginal Costing profit is the higher, or if they are the same.

We also know by how much.

If Marginal is higher, deduct the £ figure to get the Absorption Costing profit.

If Absorption is higher, then add the £ figure to the Marginal profit to get the Absorption Costing profit.

“Counting on Fingers” by AfghanistanMatters is licensed with CC BY 2.0.

5. Calculating the Absorption Costing Profit.

Now we do the other profit calculation. It is important to get the positioning of the overheads lines right (look again at the schedule), but the vital thing to get right is to make sure you only charge the Factory Overhead based on the real number of units sold.

Don’t be surprised if the profit you calculate is not what you were expecting from your calculation at Step 4. We are going to do a check in a moment. In fact, we are going to do the check even if the profit is what you were expecting because that could have arisen because of equal and opposite adjustments.

6. The checks.

There are two we should do every time, but I may not always do both in an example if I can see one doesn’t apply, mea culpa.

We will do the easy one first because it is a) easier and b) makes it easier to do the second one because you know what it should be.

We will compare the Absorption Costing profit to the one we predicted. We will either get a positive difference (higher profit than we expected), a negative difference ( a lower profit than we expected), or the profit we expected.

We firstly compare the Factory Overhead we budgeted to the Factory Overhead we actually incurred.

If we spent more (Actual higher than Budgeted), that’s bad news and we have under absorption. Bad news because we have to pay the Actual bills and this will reduce our profits. We can’t ask our customers for more money to cover the shortfall.

If we spent more (Actual lower than Budgeted), that’s good news and we have over absorption. Good news because we have more money than we need to pay the Actual bills, so we get to keep it. We don’t give it back to the customers.

Theoretically we could do this with Sales & Distribution and Administration Overhead too, but it’s unlikely a question would ask you to do this. If it does, it is exactly the same process, you’d just have two more checks.

Now we know this figure, we can net it off against the difference we calculated and are trying to explain. This leaves a number that will be explained by the next check.

We are now going to compare the Actual number of units made to the Budgeted number of units made and see what the difference is. We are then going to multiply that number by the £ amount of Factory Overhead absorbed by a unit.

If we made more units than we expected, that’s good news and we have made more money = over absorption. Good news because we are going to charge the customers for the Factory Overhead element in each unit even if we already have enough money to pay the bills. We don’t drop the cost of the unit once we’ve paid our Factory Overhead bill. Why should customers at the end of the period get them cheaper than those who bought them at the beginning of the year?

If we made fewer units than we planned, that’s bad news, we have not made so much money and we have under absorption. Bad news because we don’t have enough units to sell to cover all the Factory Overhead. We have to pay the bills, so the only way we can do that is to use the money that otherwise would be profit.

7. We now do a reconciliation using the two adjustments we have just calculated to bring the Absorption Costing Profit back to the predicted profit.

Look at the worked examples to see how that is done.

“Balancing The Account” by kenteegardin is licensed with CC BY-SA 2.0.

You may find I change the number of steps in some of the examples. Don’t worry, that’s just how I’ve numbered them as I have gone along. Whatever number I have used, I’ve done the same things each time.

Have a go. I dare you.

Further Reading:

June 2021

Marginal Cost

An example where an industry appears to be selling at below cost.

In reality, few pay the minimum price so the company (airline) does in fact make a profit.

Posted by Management Accounting Info on Monday, 28 June 2021

I keep additional materials worth reading at this location:

linoit.com/users/Jonathanrooks/canvases/Absorption%20v%20Marginal%20Costing

Possible Written Questions.

(No indication of marks – the more marks a question gets, the more you are expected to write – detail that is, not just words!) If you can’t answer these, you need to do some more reading. I do ‘find’ questions elsewhere, so these aren’t all questions I have used myself.

Comment on why the marginal costing method is considered a better method for internal reporting purposes.

Explain why under and over absorption of Factory Overhead costs occurs.

Explain what the difference in profits would be under the two systems (marginal costing and absorption costing) if production is higher than sales, if production is lower than sales and if production is the same as sales and why this would be the case.

Explain why there is often (but not always) a difference between profits recorded when using Absorption and Marginal Costing.

Discuss the arguments for adopting a Marginal Costing system and an Absorption Costing system.

“Marginal Costing will bankrupt the company”; critically discuss.

Recordings of me teaching – unedited.

These are recordings taken directly from lockdown classes from my living room, so they are not edited. I have included them solely as they may help.

1. Looking at the differences between Absorption and Marginal accounts presentations – spot the difference.

The data is within the video.

2. A worked example of developing a set of Marginal and Absorption Costing accounts and reconciling them using my method.

The data you need for the question is presented in the first few seconds of the video.