What’s it all about?

A technique in Budgeting which allows you to monitor the money coming in and going out of your business and most importantly, allows you to plan not to run out.

A Cash Budget is a plan or that summarises expected inflows and outflows of cash during a period. It helps an organisation anticipate periods when it will have surplus cash (allowing further investment in the business) and more importantly, allow it to anticipate periods when there will be a shortage of cash allowing the organisation to plan for cost reductions, make arrangements for investment or loans so that they don’t run out of cash (go out of business).

A Cash Budget will help an organisation make sure that there are always enough funds available to meet day to day needs for cash.

It doesn’t matter how much profit you make, if you run out of cash you are out of business. On the other hand, it doesn’t matter how big your losses are if you still have money to pay the bills.

We talk about how you can stay in business even though you are making huge losses provided you have cash. Here is an example from 2016. They are still in business.

The investors in Deliveroo are supporting the company, despite its losses, on the expectation of future profits.

The Golden Rule of Cash Budgeting is that we consider cash payments and cash receipts only.

If it isn’t real money coming into our account or going out of our account, then it isn’t considered. We don’t record sales we have made that haven’t been paid for yet, we don’t record purchases we have made and haven’t paid for yet. We record both of those when the money comes into the bank or we take the money out of the bank.

That’s different from a normal financial accounting approach, but in these circumstances, it is much more helpful.

“UK Piggy Bank” by Images_of_Money is licensed with CC BY 2.0.

Ignore anything that isn’t actually cash.

The main example is depreciation. This is an accounting book entry only, nobody pays anybody depreciation. It is the recording of the usage of the asset over a lifespan and even that isn’t a real. The only cash involved was what was paid for the asset when it was first bought (or any real money you get when you dispose of it).

This is often misunderstood.

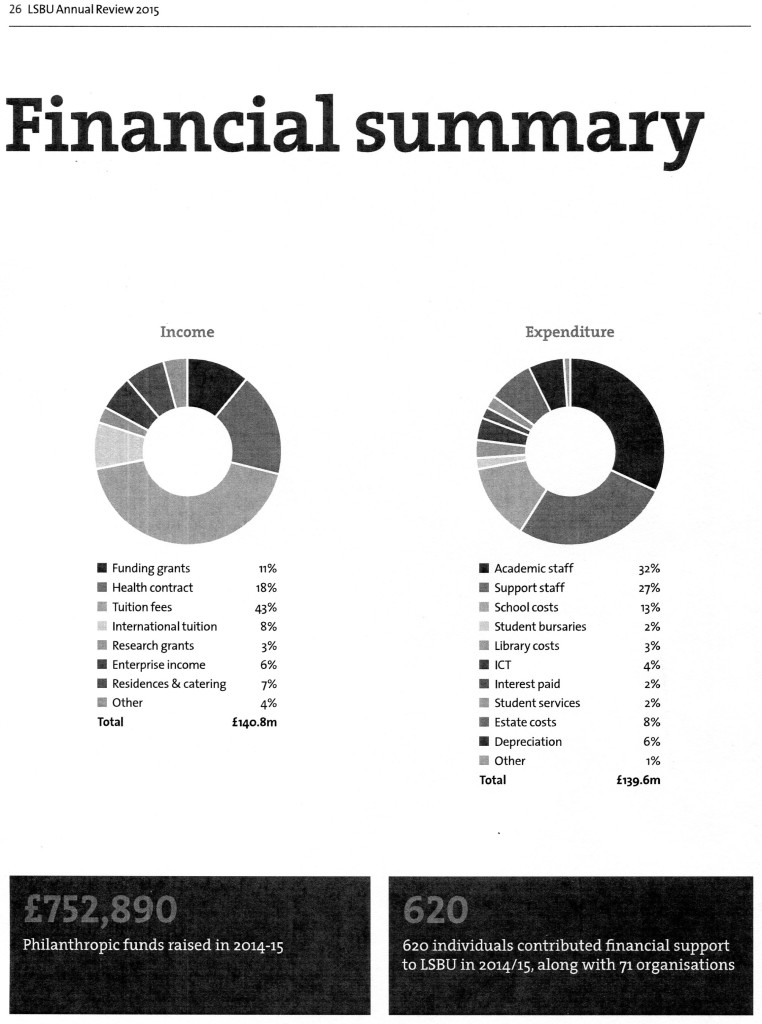

Here is an example from a university’s annual report. Note what’s under expenditure!

6% of the total expenditure isn’t expenditure at all.

Bearing in mind that we are only talking about cash…

There are other examples of things that don’t appear in a Cash Budget.

Discounts. A discount isn’t money that you get, you are just paying less than you expected. If you give the discount, you aren’t giving your customer money, you are selling at a lower price than expected. In both instances we only record the actual cash in or out when it is in or out of the bank. The money received or spent, not the discount.

Trade ins. The same as a discount really. If you give a physical thing (e.g. your old car) to get a discount on your purchase of a new thing (e.g. your new car), then nobody is giving you money, you are just giving them less.

Bad Debt. If somebody doesn’t pay you, you aren’t actually losing any money out of your bank. You are just getting less in. Bad Debt never gets recorded in a Cash Budget as it is an absence of money. There is nothing to record as we don’t record the cash until we get it anyway.

These three are also very different from what we do under Financial Accounting. But, we are not doing Financial Accounting, we are doing something much more interesting (Management Accounting).

The three rules that you need to apply.

Include everything.

Don’t forget to include every line of expenditure or income in your Cash Budget. A forgotten income (Christmas cash from your Gran) will be a nice surprise, a forgotten expenditure (your car insurance) could be a disaster and take you over drawn.

Accuracy.

Use the right number, not a guess. If you can’t get the exact number then underestimate income and over estimate expenditure. That way, if you are wrong, it is not likely to be a disaster.

Obviously, the more significant (larger) the number, the more important it is that you get it right.

Timing.

The money is only recorded when it will go into your bank account or leave your bank account. This is probably the most important aspect to make sure you are getting right.

Cash and Credit Sales.

This is the main area where we have to deal with timings.

Cash sales are those where you are given actual money. That’s pound notes and coins in your till. However, it does depend on how regularly you are doing your Cash Budget. Daily? Weekly? Monthly?

A credit card/ debit card purchase would only be a cash sale if you get it in the bank today. If there is a delay, you should only record it when it is going to be in your bank account. If the delay is very short, it would be easier to consider it as arriving now.

So, if you were doing your Cash Budget on a weekly basis, then it would be fine to include those sort of sales within the week. It is all going to depend on the size of your organisation and the reality of the scale of real cash payments you receive. Lots if you are a Newsagent, not much if you sell new cars.

This is a big difference from Financial Accounting when you record the sale in its entirety when it has been made. But, we are not calculating profit, we are making sure the company doesn’t run out of money.

Don’t forget one off purchases or payments made annually when recording the right time for a payment. This is also part of the ‘include everything’ that you need to look at.

Credit Sales. It all depends upon how long you give your customers to pay. Normal terms might be 30 days, 60 days or 90 days. You record the income in your Cash Budget 30 or 60 or 90 days after the sale is made.

In seminar and exam questions these are usually done as months. So sales in January on two month credit terms would be recorded in March.

What about Bad Debt? We know it isn’t a cash entry (it’s an absence of cash), but it does mean we won’t get all of the credit sales into our bank account when we expect them. The normal method would be to discount the anticipated income by the percentage of your sales that you would expect to be bad.

Say you sell £10,000 worth of goods in January on two months credit. If all goes well, you will have £10,000 in your bank account in March. If we assume that you have 5% bad debt, then your assumption would be £10,000 x .95% = £9,500 in March. The 5% bad debt (£500) doesn’t appear in the Cash Budget although it will appear in our financial accounts.

Layout of a Cash Budget

Basic format:

Receipts X

Less: expenditure (X)

= Net X

+ Cash brought forwards X

= Cash carried forwards X

Obviously, all recorded in £ (or relevant currency).

We list all the lines we have for income and end up with a total for receipts. Then we list all the lines of expenditure in our budget and the total for expenditure.

Takin expenditure from receipts will give us the surplus or loss for that period. Remember, it doesn’t matter if you have a loss as long as you have enough money to pay the bills.

This number is then added to or taken away from the amount of money we have in the bank (the cash brought forwards) to tell us how much we have left, the cash carried forwards.

Here is an example, the answer to a question. The details of the question aren’t important here, but note how we net off expenditure (payments) against total receipts to get a net figure that is then added/subtracted from the opening bank balance to give the closing bank balance.

Loading...

Loading...

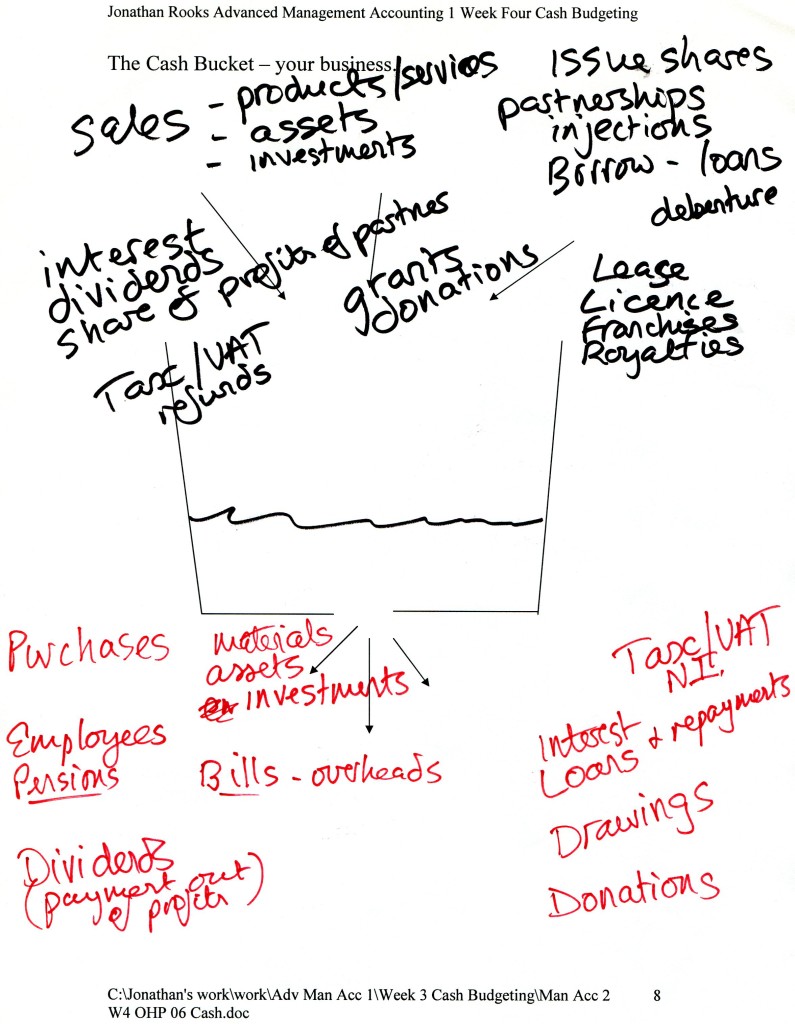

The business as a leaky bucket.

Distraction Warning! Ignore the next video, you are meant to be working!

I can’t think of holes in buckets without singing this song to myself.

You don’t need to be profitable to be in business.

You don’t need to be profitable to be in business, just have backers that have faith that you will break even by 2020 as does Victoria Beckham although she had a near £9 million loss.

Smaller businesses don’t necessarily have that level of support so ensuring that you don’t run out of money is critical.

Sources of funding.

The main issue is knowing in plenty of time that you might need additional funding. That’s part of the function of a Cash Budget, to alert you when you might have a potential funding problem in the future.

There is no point finding out that you are going to run out of money in a couple of weeks. It is unlikely that you are going to be able to do anything sensible to raise cash to fill the gap.

If you have plenty of notice your options are greater and you are in a better position to make an effective business decision.

The broad categories of activities you can do.

You can increase the money coming into the bucket or slow the flow out of the bottom of the bucket. All are problematical. How would you answer if asked?

Sell part of the business/gain internal investment (sell further shares). “Do you want to invest in my business, we are running out of money?”

Borrow money from a bank. “Do you want to lend cash to my business, we are running out of money?”

Pay your bills later. “Is it alright if I delay paying you as I am running out of money?”

Collect money owed to you quicker. “Do you mind paying me sooner than we agreed as I am running out of money?”

Grants/Subsidies. These aren’t repaid and you usually have to have a good social/political/economic reason to get one. “Could you help me please by giving me some money?”

October 2016. We don’t know what was agreed, but the Conservative’s help for Nissan will certainly impact on their budgeting – a subsidy in this instance.

Changing sales prices. But, will you get less money in total because you have sold fewer units because you have put your prices up? If you put your prices down, will you get the cash in larger quantities quickly enough to bridge the gap?

Change your business process to reduce costs. But can you do this in the timeframe required? Yes if it is months, no if it is weeks.

Sell assets (including stock) at a huge discount to get cash in. The ‘Fire Sale’ approach. You get rid of everything you can for whatever money you can get. You might make a loss, but you have cash. You also might not be able to put your prices back up to their normal level later though if you sell your product off cheaply.

There are no easy methods. All are harder if you are trying to do it in a hurry. The further ahead you have predicted a cash gap (with your Cash Budget) the better are the chances of you covering it with a sensible business decision.

“Everything Must Go” by Random Retail is licensed with CC BY 2.0. To view a copy of this license, visit https://creativecommons.org/licenses/by/2.0/

A worked example.

(Do remember that different teachers may use different techniques and different terms).

Practice Questions

(These aren’t mine, but should be useful for you. Do remember that different teachers may use different techniques and different terms).

Some good discussion of Closing Balances and planning for borrowing in this one..

Quite a comprehensive question and useful to see how an Excel spreadsheet has been used.

A worked exam question here.

http://www.managementaccounting.info/wp-content/uploads/2015/10/sa_may12_f2fma-cash_budgets.pdf

Laying out a cash budget in Excel.

https://youtu.be/8_80wlSlA9s

Further Reading.

(Articles and news items related to this topic to put it in context for you).

How much do you need in the bucket?

Cash Budgeting

You can’t spend it until it is in your bank account, so a sale isn’t really worth anything to you until…

Posted by Management Accounting Info on Wednesday, 5 January 2022

Cash Budgeting

What happens when you run out of cash?

Interesting to read about the decline of a once great football…

Posted by Management Accounting Info on Tuesday, 28 September 2021

Cash Budgeting – cash isn’t the same as profit.

We discuss how you can be losing money but still in business if you…

Posted by Management Accounting Info on Tuesday, 7 September 2021

September 2021

What happens to a football club that runs out of money?

Cash Budgeting

What happens when you run out of cash?

Interesting to read about the decline of a once great football…

Posted by Management Accounting Info on Tuesday, 28 September 2021

Cash Budgeting – cash isn’t the same as profit.

We discuss how you can be losing money but still in business if you…

Posted by Management Accounting Info on Tuesday, 7 September 2021

March 2021

Cash Budgeting

I’ve read of many instances where business owners have lost a lot because of running out of cash. this…

Posted by Management Accounting Info on Sunday, 7 March 2021

June 2020

Cash Budgeting

This article about the risks facing ares dependent upon Tourism shows the seasonal nature of income. an…

Posted by Management Accounting Info on Friday, 26 June 2020

Cash Budgeting.

We know this is all about making sure that you don’t run out of money.

Many companies are in a…

Posted by Management Accounting Info on Wednesday, 10 June 2020

The problems facing holiday provider Thomas Cook.

The issue for them arises from a shortfall in cash. Not cash for day to day operations in this instance, but to meet a requirement from the bank to have sufficient funds to meet contingencies.

We use the illustration of a leaky bucket to discuss cash budgeting. As long as there is water is in the bucket, you are in business. In this instance, there needs to be £200m of ‘water’ in the bucket for Thomas Cook to stay in business.

https://www.bbc.co.uk/news/business-49761464

102 jobs lost at one company.

Unfortunately, a common occurrence. A company goes out of business and 102 people lose their jobs as a major customer doesn’t pay in the time period they should.

A typical example.

http://www.kentonline.co.uk/dover/news/burgess-marine-dover-in-administration-157065/

You can delay paying some creditors, but if you don’t pay your tax bill, then HMRC will put you out of business.

https://www.bbc.co.uk/sport/football/47641126

Running out of money.

We talk about how you mustn’t continue to trade if you know you r going to be insolvent (run out of money). here is an example of an individual who continued to take money from customers and what happened to them.

This is probably the strangest example though.

Cash Budgeting

I’ve read of many instances where business owners have lost a lot because of running out of cash. this…

Posted by Management Accounting Info on Sunday, 7 March 2021

Carillion

Struggling companies often delay payments to suppliers. Big companies often delay payments to suppliers.What happens if you are doing work for a big company that is struggling?

50,000 companies a year go out of business as the cash didn’t arrive when expected.

We treat this as if it is a theoretical concept, but late payments are forcing 50,000 small companies out of business every year.

This really emphasises the importance of cash budgeting and taking a very cautious approach to your expectations of when you will receive the payment.

Advice to businesses on how to cash budget.

Late payments leading to companies paying their own bills late. But paying the VAT late can lead to penalties.

“Late payments add to problem of VAT arrears

Britain’s late payments culture is to blame for another increase in the amount of VAT that has not been paid on time to HM Revenue & Customs, a leading finance company is warning. LDF says small and medium-sized enterprises often have little choice but to pay their VAT bills late because their cashflow is not sufficient to cope with the late payment of bills by customers.

Official figures show that VAT arrears now stand at £2.58bn, up from £2.55bn in 2014. Most companies pay VAT on the basis of the bills they have issued to customers, rather than the payments they have received, so late payments can cause serious problems.

Peter Alderson, the managing director of LDF, said these pressures were also preventing firms exploiting growth opportunities. “Even though economic growth is accelerating and order books are growing, the problem of VAT arrears does not appear to have improved,” he said. “This is a time when businesses should be able to make significant investments in staff and equipment as the economy grows, but late payments can make this difficult for a lot of SMEs.””

Part of this longer article.

Abuse of power – not paying your suppliers.

We talk about careful management of inflows and outflows to keep our cash balance healthy. Here is an example of a company taking it to extremes by abusing their position of power in the relationship.

You can see why dealing with large companies is actually an indicator of risk in small businesses. all your orders to one company that then delays paying you for ever.

http://www.bbc.co.uk/news/business-35408064

Possible Written Questions.

(No indication of marks – the more marks a question gets, the more you are expected to write – detail that is, not just words!) If you can’t answer these, you need to do some more reading. I do ‘find’ questions elsewhere, so these aren’t all questions I have used myself.

Comment on the use of a cash budget in budgetary control.

What are the determinants of what should be included in a cash budget?

Outline what should and should not be included in a cash budget.

Explain the function of a cash budget.

What are the advantages of preparing a cash budget?