What’s it all about?

A technique you can use to simplify decision making when setting selling prices/considering alternative options that takes out all the complication of things that are not going to change anyway.

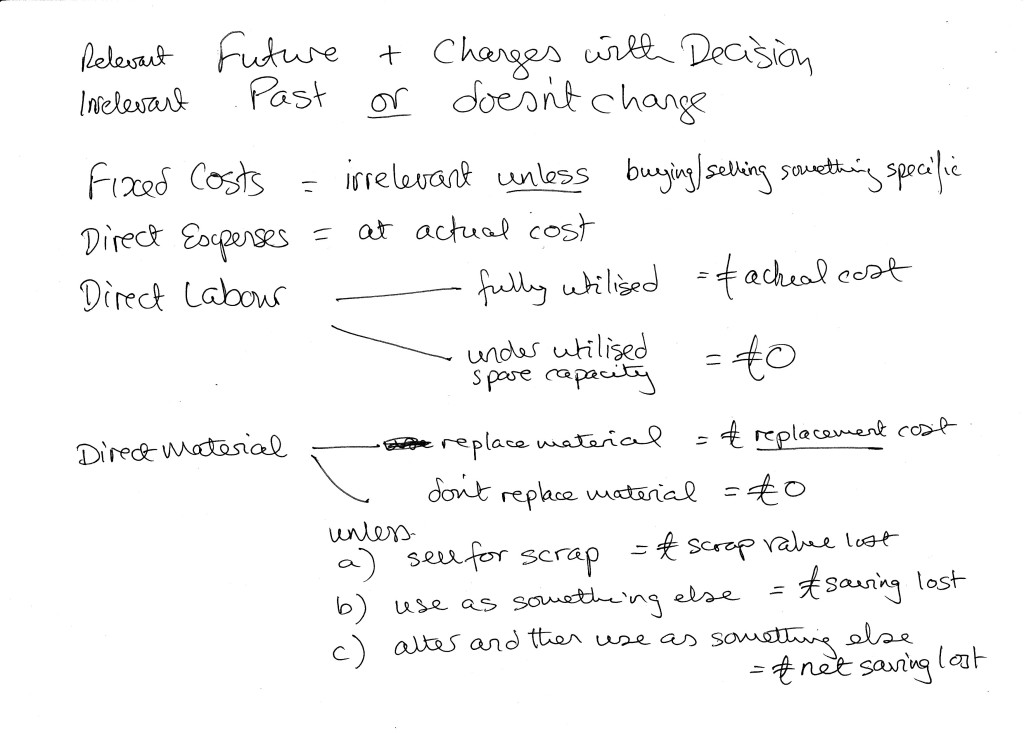

The only things that are relevant are those that change because of the decision.

Note the irrelevant cost (rocket) and relevant cost (catering) in the moon landing.

If nothing changes, no need to mention it.

Take football formations for example.

4-5-1, 4-4-2.

The obvious thing is that they add up to ten, not eleven (the number of players). That’s because the goalkeeper is always in the same place, the goal, so there is no need to mention them. No change, whatever the formation.

Loading...

Loading...

Further Reading.

Committed costs – a category of sunk cost where you will continue to pay (in the future) even after you make the decision to not continue.

Relevant Costing – Committed Costs

I usually give the example of the sacked football manager whose contract still needs to be paid even after he (its always he) has been replaced as an example of committed costs. That is, costs you pay in the future but that arise from past decisions. These are therefore irrelevant in decision making as they don’t meet the criteria to be relevant – a future cost/income arising from the change in decision.

Here the £5 pay-off arises from the decision to employ Van Gall in the first place. The next 12 months salary was unavoidable as it was part of the original contract and therefore should not have been considered in the decision to replace the manager.

An interesting article anyway for examples of poor management of a once huge football club, but our main management accounting point from this – the committed cost of paying for a contract even if you don’t want the employee (therefore their salary is not a relevant cost).

“Managers keep coming and going, too. Steve Evans, whose first home game against Blackburn Rovers is on Thursday, is the sixth in 18 months and the payouts due to the dismissed keep mounting. Cellino is thought to be the only owner in British professional football to be paying, or paying off, four managers concurrently (Evans, Redfearn, Uwe Rosler – dismissed last week – and Darko Milanic.) “

But four salaries of sacked managers!!

The sunk cost fallacy.

The idea that we must do something because we have already spent money.

We talk about the situation in Relevant Costing, Budgeting and Investment Appraisal about how humans have a tendency to continue with investments when they no longer make economic sense because ‘we’ve spent all this money so far and it would be wasted if we didn’t carry on’. That’s the sunk cost fallacy.

I haven’t caught any fish in this bucket over the last three days, but if I quit now I will have wasted all that time.

“Hey is there something wrong with drinking water from a bucket in the bath?! HUH?!” by Snipergirl is licensed with CC BY 2.0.

Real world examples.

Relevant Costing -Sunk Costs – Committed Costs

We ignore Sunk Costs when using Relevant Costing.

Committed Costs are a…

Posted by Management Accounting Info on Thursday, 14 October 2021

Relevant Costing – Sunk Cost

We discuss under this topic the very human trait of continuing to spend money just because…

Posted by Management Accounting Info on Tuesday, 17 August 2021

An example with £43 million wasted on planning an impractical bridge. At least they didn’t waste billions trying to build it. Boris Johnson likes a grandiose, impractical project as it makes him look good to some. Bridge from Scotland to Northern Ireland, new airport built on a man made island in the Thames anyone?

Life Cycle Costing / Sunk Costs

A further £500 million added to the costs to build a nuclear power station.

A rational…

Posted by Management Accounting Info on Thursday, 28 January 2021

This podcast discusses both the Sunk Cost Fallacy and the reality of Opportunity Costs in the context of people’s own decisions about their careers and lives. You might find this helpful.

HS2

Here is a another Government project that could easily turn out to be a huge waste of money. What chance of them not spending the extra £43 billion pounds after ‘we’ve spent all this money so far and it would be wasted if we didn’t carry on’.

https://inews.co.uk/news/politics/ministers-facing-anger-o/

Always interesting to see examples of projects being continued with long after they are in reality no longer worth it. The old “we have spent so much that if we don’t continue we will have wasted it” fallacy.

The issue of whether we (the Government spending our taxes) should continue to fund a project with hugely escalating costs. Remember that under Relevant Costing we only consider future costs that will change and ignore past costs. We don’t proceed because we have spent so much money already, but only if the additional expenditure is justified by the benefits.

My view is that it isn’t.

Sep 19.

The future of HS2 should be decided on a cost benefit analysis, particularly now that the total cost is soaring.

“Government officials have refused to rule out scrapping the project entirely, despite delays and billions having been spent already.”

A lot of opposition at a senior level to the HS2 rail project and a call to “stop throwing money down a black hole”.

https://www.bbc.co.uk/news/uk-england-stoke-staffordshire-45495405

Mind you, talking of escalating rail costs, I do think we should continue to support Crossrail.

Crossrail good, HS2 bad (because of the habitat destruction – the biggest clearance of ancient woodland since the war).

Comparing long term and short term costs.

This article discusses the argument over whether it is better (in cost terms) to keep prisoner in jail or parole them (and invest in other ways of stopping them from reoffending).

The issue is what was the true Marginal Cost of keeping someone in prison. The article rightly draws the distinction between the costs that would change and those that wouldn’t. A full discussion would include the costs of alternative treatments other than prison.

The difference between the marginal $12 rate and the $91 fixed cost rate for the Greensboro jail is that, if 10 or 20 people are removed from jail, those fixed costs don’t change. The jail still has to be heated, the electric bill paid and the facility must be staffed with guards, nurses and janitors. Also, the same debt has to be paid on the $92-million Greensboro jail whether that jail is full or empty.

But other costs such as food, provisions and medical services do go up or down depending on the number of inmates being held – so Guilford County does save some money each time an inmate is allowed to await trial at home.

According to Kittelson, the marginal cost of housing an inmate in the Greensboro jail is $12.54 a day, while the cost at the High Point jail per inmate per day is $17.23. That’s still a savings on each inmate out of jail, but it’s much less than the $73 a day the county has generally used for those calculations.

Watch this.

Another introductory video if you need it…

https://youtu.be/dU3PT8EAxDU

https://youtu.be/5PAmWobTdxc

Thinking about Labour Costs in Relevant costing.

Interesting perspective on unskilled labour in this presentation from another country. If ‘he’ is unskilled you will only use him when necessary, so therefore unskilled is relevant.

We know that we treat skilled and unskilled labour the same. If you have already paid for their time, then you only have to pay for more hours when they are working at full capacity. That gets talked about here in the context of skilled labour but assumes that all unskilled is on essentially zero hours contracts.

Not the case in a UK context.

Always interesting to see how other people approach management accounting issues, but you need to think how it applies in your own business environment.

Possible Written Questions.

(No indication of marks – the more marks a question gets, the more you are expected to write – detail that is, not just words!) If you can’t answer these, you need to do some more reading. I do ‘find’ questions elsewhere, so these aren’t all questions I have used myself.

There is a lot of similarity in written qeustions on this topic. That’ll help you focus.

Explain the differences between Relevant and Irrelevant costs (and revenues).

Explain in which circumstances it would be appropriate to use Relevant Costing.

Describe the different treatments of costs for materials in Relevant Costing.

Define the term ‘relevant cost’ and give examples of both relevant and non-relevant (irrelevant) costs.

Explain the meaning of the terms ‘Sunk Cost’ and ‘Committed Cost’.

Discuss the limitations of using Relevant Costing in preparing costs to charge customers.

Explain why Relevant Costing should not be used in all pricing decisions.

Explain the terms Relevant Cost and Irrelevant cost.

Explain the concept of Opportunity Cost.

Outline the treatment of Direct Materials, Direct Labour, Direct Expenses and Fixed Costs when a business has chosen to use Relevant Costing to calculate the cost of production.

Your manager has been reading about Relevant Costing and how this allows a company to lower its costs. She thinks that the company should adopt Relevant Costing. Write a memo explaining the circumstances in which Relevant Costing would be an appropriate costing method.

Comment on the use of Relevant Costing to prepare quotations for jobs.

Discuss when it would be appropriate for a company to adopt a Relevant Costing approach.

Discuss the limitations of using Relevant costing when calculating unit costs.

What determines the treatment of materials costs under Relevant Costing?

What determines the treatment of labour costs under Relevant Costing?