What’s it all about?

The basic terminology and concepts that you will need to know to be able to do any Management Accounting.

Most of them also crop up in Financial Accounting and in general discussion of business.

You’ll need to know this stuff even if you never do any accounting yourself but employ others to do it for you.

If you need more than my word for it, watch Yasmina get interviewed for a £250K a year job!

The importance of understanding accounting terminology.

What you should be able to do.

Explain the differences between direct and indirect costs.

Explain the differences between variable costs, fixed costs and stepped fixed costs.

Separate the fixed and variable costs from a semi–variable cost.

Write a standard cost schedule.

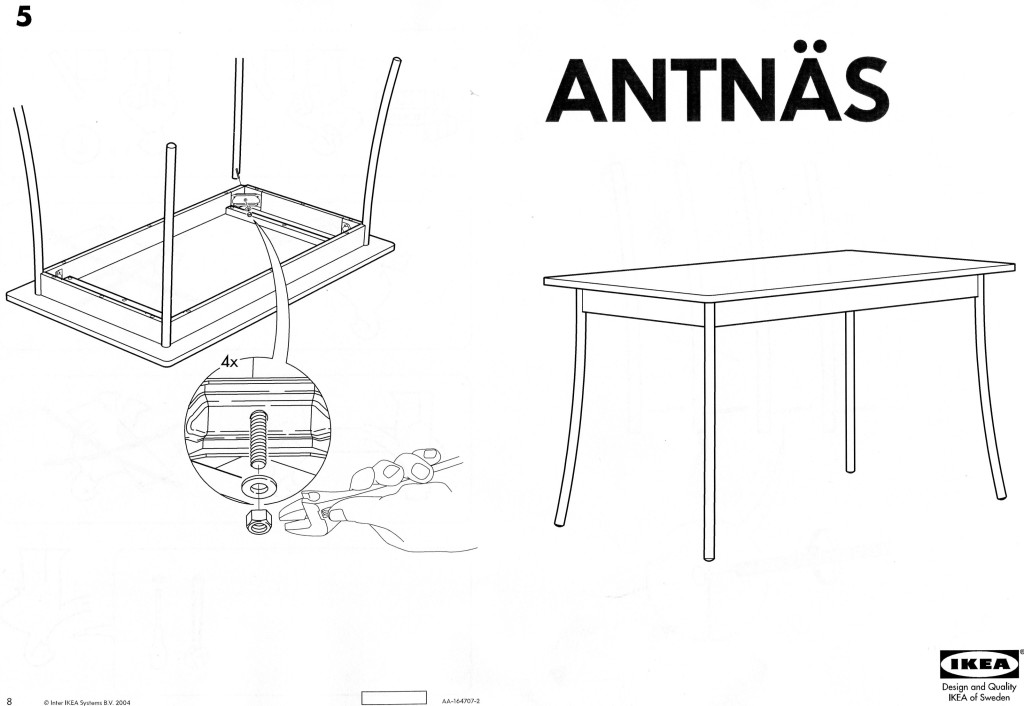

We are all probably familiar with assembly instructions – a good way for us to think about Direct and Indirect costs.

Anything that is needed to physically make the table is a Direct Cost. So basically, if you can kick it, it is Direct.

Direct Materials – that’s the top and the legs. You might also say the screws, but see Direct Expenses in a moment.

Direct Labour – yes you can kick the time taken to put it together. If it hadn’t been put together, it wouldn’t be a table, just a pile of bits on the floor.

The only difference between the pieces of the plywood chair in the photo below and the finished item is the Labour that’s put them together. That makes the time spent putting it together a Direct cost too.

Image of a model both in parts and completed.

“seier+seier plywood chair christmas card 2009” by seier+seier is licensed under CC BY 2.0

Direct Expenses – not one you will see in every question, they tend to be the things in the product that are too awkward to measure separately or not valuable enough to spend the time on counting every time.

Typical examples would be the screws and varnish on the table top. You are never going to use more than one top or four legs, but you might use a different number of screws or a slightly different amount of varnish.

So usually either things that are of low value and not worth counting each time, or they are of high value but difficult to measure every time. You would use a set amount as the cost every time even if in reality you might use a bit less or more each time.

These three together make our total Variable cost of a table.

- Direct Materials (DM)

- Direct Labour (DL)

- Direct Expenses(DE)

Indirect Costs – anything that isn’t physically required to make the table. These are all the costs you incur to be able to make the table – e.g. your tools, the room where you do it, the supervisor, the lighting.

You need them, will spend money on them, but they are not ‘in’ the table.

You are not going to want to run your business outdoors all year round.

“Outdoor Office” by darkday. is licensed under CC BY 2.0

“Outdoor Office” by darkday. is licensed under CC BY 2.0

What if I don’t make a physical thing?

If you aren’t making chairs and tables but providing a service then the principles still apply. Usually what happens is that the amount of Direct Material is low or non-existent, but the level of Direct Labour is very much higher and there may be Direct Expenses.

“Dentist” by HerryLawford is licensed under CC BY 2.0

The actual amount of Direct Materials your dentist uses are probably small (the fillings?), but the time (Direct Labour), the anaesthetic (hopefully), electricity and disgusting pink mouthwash could be significant (Direct Expenses).

Unless you do dentistry outside, you will have a place of work (Indirect cost). Even if you set up your dentistry practice in a market place outside so you didn’t have a building you would still have Indirect costs for your equipment.

“Dentist on the market” by SpAvAAi is licensed under CC BY-NC-ND 2.0

“Dentist on the market” by SpAvAAi is licensed under CC BY-NC-ND 2.0

Our three categories of Direct Costs make up our Variable Costs.

We have seen that the three categories of Direct Cost make up our total Variable Cost – so each is in itself a Variable Cost. But what do we mean by Variable Cost?

There are loads of different definitions, but I think mine is the best. Google a few and see what that brings up.

“A cost which in total varies with the level of output, within a range.”

The key points:

‘in total’, ‘varies with output’ ‘within a range’.

A table top is going to be the same price individually every time – it is not the price of the table top that varies but the total amount we pay for table tops.

Let’s say £10 for one, then that’s £20 for two and £70 for 7.

The table tops are not varying in price individually, the total price is.

That’s the ‘with output’ bit.

The more we buy, the more we spend (buy fewer and the total cost goes down) and this change is by the amount a table top costs.

“Natural Brass Hexagolal Table Tops” by Metal Sheets Limited is licensed under CC BY-NC-SA 2.0

“Natural Brass Hexagolal Table Tops” by Metal Sheets Limited is licensed under CC BY-NC-SA 2.0

We said we paid the same price individually for each table top, but that doesn’t always apply.

If we buy loads and loads we are going to expect a discount – that’s the ‘within a range’ bit. the cost isn’t going to change within the range of units up until the point where we are going to get a discount.

A change in the cost of buying an item is not a variable cost.

There are things that vary in price regularly. We are all familiar with petrol prices at the pump changing every few days. This is not ‘variable’ as we mean it in Management Accounting terms.

Our Variable Cost would be the total of the units x the price we paid that day. It might be a different number, higher or lower. tomorrow.

So what about the Indirect Costs?

Well some Indirect Costs might vary, but we would probably treat them as Direct Expenses if it was worth measuring them specifically.

We didn’t treat the electricity in the drill we used to assemble the tables as a Direct Expense, but we could have done.

It would have been a faff to measure it as a lot depends on how light your trigger finger is. Much easier is to measure the total cost of electricity and treat it as an Indirect Cost.

Management Accountants are lazy efficient, so we like to do things the quickest way.

“File:A boy with Down syndrome using cordless drill to assemble a book case.jpg” by Rob Kay (en:User:Excalibur) is licensed under CC BY-SA 3.0

“File:A boy with Down syndrome using cordless drill to assemble a book case.jpg” by Rob Kay (en:User:Excalibur) is licensed under CC BY-SA 3.0

Why don’t I hear the term Indirect Costs all the time then?

Indirect Costs are usually called Fixed Costs or Overheads and that’s pretty much interchangeably.

There are loads of different definitions, but I think mine is the best. Google a few and see what that brings up.

My definition:

“A cost which DOESN’T in total vary with the level of output, within a range.”

A definition where we essentially have a doesn’t instead of a does.

If you make tables in a room you are renting, you have a rent cost every day.

The total cost is the number of days x daily rental. So the total will change if you use the room for longer, but…

Make one table today and the rent is the same as if you made ten tables today, or even no tables at all. It is not changing with the ‘level of output’.

It doesn’t mean that it will never change.

You might rent for longer this year than last year or the landlord might put the daily rent up. But it is not changing with the number of tables.

Let’s consider the ‘within a range‘ bit.

There will come a point when you want to make more tables than the space in your room allows. To make more you are going to have to get another room – a bigger one or a second one – now your total rent will go up.

We will look a this scenario more further down when we consider Stepped Fixed Costs.

Let’s look at how total costs are affected by production then.

The first thing you will see is how we are using a Standard Format (Direct Materials, Direct Labour then Direct Expenses – if we have them in the question).

Not compulsory to do this, it’s up to you, but much easier to understand if we do it the same way.

the other thing to mention now is that lazy efficient Management Accountants normally abbreviate these to DM, DL and DE.

Here’s the costs of making one unit of our product.

| Direct Material per unit | £ 10.00 |

| Direct Labour per unit | £ 8.00 |

| Direct Expenses per unit | £ 2.00 |

| Total Direct cost per unit | £ 20.00 |

And let’s say it costs £500 per week to rent our room where we make the product.

We can see then that making one unit in a week will have a variable cost of £20 AND we will have to pay £500 for the room for the week.

Breaking it down, the variable costs for different levels of output will be as in the table below. Note how the total varies with output, the cost of each table stays the same.

Ten tables = £200 and 90 tables = £1,800.

As you can see in the graph, this is a straight angled line. We are clearly still ‘within the range’ for this item as the price per unit hasn’t changed.

Plot a graph yourself to see how it goes. There is an Excel spreadsheet you can play with further down the page.

(Sorry about using pdfs posted into the blog, but Excel is a nightmare to use in WordPress)

Now we are going to plot the Fixed Costs in a graph.

It is £500 in this example we are doing and it doesn’t change with the number of units, so a nice straight horizontal line.

If we want to look a the Total Cost, then we are going to have to add the Variable and Fixed Costs together.

You just put the graph for the Variable Costs on top of the graph for the Fixed Costs.

So, that’s the basics, the most important concepts. All covered again, in different voices, in the videos below. If you want to play with the Excel spreadsheet that was used in the example above, you can access it here: Excel spreadsheet for variable and fixed cost graphs

Using the information to calculate costs.

We use a standard layout for the calculations (it’s not that you have to, it’s just easier to understand if we tend to do the same thing).

When doing questions you will probably not refer to the prime cost as the prime cost, I’ve only clarified it here in case you come across the term somewhere else.

Don’t worry about the different categories of Overheads, we will cover them elsewhere. Just for now remember that the Fixed Costs we have been talking about so far are for the place that you are doing the work, so they are known as the Factory Overheads.

We will probably do calculations using the above format where we also have sales figures.

In that case, Sales -Prime Cost = Gross Profit. And, Gross Profit – Overheads (all three of them) = Net Profit.

Although in practice we don’t use the term Prime Cost very much, we would usually say

Sales – Variable Costs = Gross Profit.

Gross Profit – Overheads = Net Profit.

Net Profit is the bit you get to keep/pay tax on.

We will cover all of this in more detail elsewhere too.

What else do we need to know?

Stepped Fixed Cost.

“steps, Bradford University” by Tim Green aka atoach is licensed under CC BY 2.0

“steps, Bradford University” by Tim Green aka atoach is licensed under CC BY 2.0

Thinking back to our previous example, we said we could make units in a room costing us £500 to rent. There will be a limit to how many we can do in that room in a week (that’s the ‘within a range’ bit of our definition).

Say we can do 30 in a week in that room. If we want to make 31 in a week, we are going to need a bigger room or another room.

Our fixed cost will then go up.

It will go up again in the future when we reach the capacity of that extra space and have to get and even bigger room (or a third room) and we now want to do 61 units.

This will give us a Fixed Costs Graph with a series of horizontal lines at different levels of production. the graph looks like as series of steps.

We’ve assumed that each step is the same charge as the previous one. That’s just to draw an even graph. Your second and third rooms (pieces of equipment or whatever) might be different costs.

I’ve assumed here that we can make up to 30 units with a fixed cost of £500 and that every increase of up to 30 costs and extra £500 fixed costs.

This four-minute video will explain it for you too. This chap (American) calls them Stepped Variable instead of Stepped Fixed (he is American), but the explanation is good.

Semi-Variable Cost

This is the term for a situation where the total cost changes with output, but we don’t know how much of the total cost is caused by the variable cost element and how much is caused by the fixed cost element.

It’s as if we only have the upper total cost line as in the graph above. The one that starts at £500 and goes up from there.

There is a technique for working out how much is variable and how much is fixed. It’s called ‘separating a semi-variable cost’ and we will see how to do this simple technique on another page.

(There is another method – the High Low Method – which we will look at elsewhere on this site. By the way, I don’t like it, I don’t think you can trust it).

Other Terms

You may come across these, they are used elsewhere in specific situations, this is just to make you aware of them.

Period Cost/Product Cost.

Usually considered at the same time.

Product costs are those included in the product themselves (like the direct materials, direct labour, direct expenses we’ve talked about and the factory overhead sometimes) – they are in the value of the stock. This is discussed on another page.

Period costs are costs incurred (we’ve spent money on) but are not in the product value. So they are usually costs associated with selling the product or administration of the business. This is dealt with on the Overheads page.

Expired Cost/Unexpired Cost.

I haven’t come across this much in exams, but just in case…

If you spend money say on a raw material and haven’t used it all… the stuff used is the expired cost, the stuff you haven’t used is the unexpired cost.

Watch this.

(Remember, videos like these that are produced to cover whole topics may include material that isn’t relevant to your own exam at your institution. don’t get hung up on it)

Somebody else who uses tables as their example. A review of variable and fixed costs including relevant range.

More on Variable and Fixed costs including an explanation of Stepped Fixed Costs plus comments on the Relevant Range.

Another video explaining the difference between Fixed and Variable costs.

Further Reading:

I’ll post stuff here if I find anything important, otherwise keep an eye on the Facebook page for posts relevant to this topic. It tends not to be a subject itself because it is the building blocks, but it is involved in most issues in some way.

Comparing your business to others – Benchmarking.

The Office for National Statistics has a calculator that enables businesses to compare their performance to others in their sector.

Very useful to compare your inputs of labour, materials etc. to benchmark against your competitors.

“Productivity is a measure of the amount of output a business produces for a unit of input. In its simplest form, labour productivity measures the amount of output produced per worker: higher productivity means that a business produces more output for each worker it employs.”

How Factory overheads (a form of Fixed Cost) can increase over time as you switch from people to equipment.

Costs shift from Direct Labour to Factory Overhead as you buy equipment rather than employ staff. A possible consequence though is redundancy of equipment. Usually people can be retrained as your requirements change. Equipment cannot always be repurposed. Think of the expensive electronics you have lying around the house that you don’t use.

http://www.independent.co.uk/life-style/gadgets-and-tech/does-the-next-industrial-revolution-spell-the-end-of-manufacturing-jobs-a7850886.html

Posted by Management Accounting Info on Thursday, 12 November 2020

Might happen to me too.

Only 10, 9, 8, 7 years to go.

Robot teacher will replace humans in the next ten years.

An example of a semi-variable cost – water bills.

An example from Canada applied to water supply. Note how the fixed costs are loaded on to those most likely to use the most water (a good idea) rather than being equal for all customers.

Your water bill is going to have a fixed cost associated with the size of your supply and a variable cost charged at the amount you use. No discounts for big users which strikes me as a good idea if you are trying to save water.

Each company/industry will have specific ways of monitoring costs depending upon the nature of their business. If you are in road haulage it will be costs per mile. the marginal cost is the variable cost of driving per mile and note how this is made up of principally divers’ wages and fuel.

“ATRI’s report, An Analysis of the Operational Costs of Trucking, found that the average marginal cost per mile in 2014 was $1.70 compared with $1.68 in 2013. This comes despite decreasing fuel costs in the same period of time.”

How costs are becoming less variable and more fixed.

Over time there has been a transition from Variable Costs (Labour here) to Fixed Costs (allocated per machine hour). The trend continues. This reduces Variable Costs as a percentage of total costs, but to a certain extent makes companies less adaptable if they tie up vast sums in capital equipment.

Canada Will Lose Up To 7.5 Million Jobs To Machines: Report

Even doctors, lawyers and engineers won’t be spared.

HUFFINGTONPOST.CA

Possible Written Questions.

(No indication of marks – the more marks a question gets, the more you are expected to write – detail that is, not just words!) If you can’t answer these, you need to do some more reading. I do ‘find’ questions elsewhere, so these aren’t all questions I have used myself.

You are unlikely to get a significant written question on these topics as they are the basic building blocks of the rest of your studies of management accounting.

You might be asked to “distinguish between” different types of cost or to give brief definitions, but expect more to have multiple choice type questions or short questions. I think it unlikely that you would have a long written question as this is all so basic.

And now you know it, easy.