What’s it all about?

Techniques for determining the price we should charge for our products/services.

We tend to assume there is one price for a product, it certainly makes the calculations easier, but if you have a favourite sweet, you’ll soon see that that is not the case.

The common approach in class is to assume that we can use a formula to calculate the Optimum Selling Price and Optimum Selling Quantity.

It’s quite straightforward to do, so widely taught. As with anything easy though, there are a considerable number of weaknesses with it as a concept.

Worked Examples.

Take a look at these two. Do them, then turn your computer upside down to see if you got the right answer.

Not inflated then?

Watch this.

(Remember, videos like these that are produced to cover whole topics may include material that isn’t relevant to your own exam at your institution. don’t get hung up on it).

Further Reading

The right price?

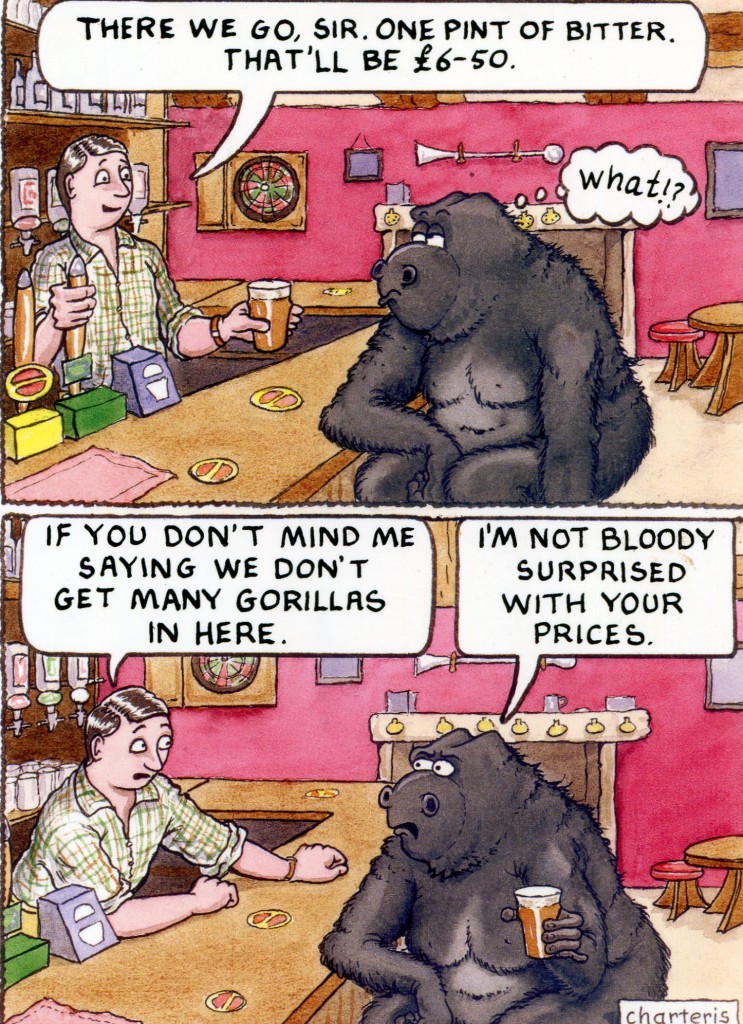

We often think there is a ‘right price’ for a product, and then something surprises us.

https://www.standard.co.uk/…/alain-ducasse-cafe-perfect-cof…

Confidence in low prices.

The calculations assume a straight line relationship between price and sales. We know that one of the weaknesses of this argument is confidence in the value of items at lower prices.

How do you feel about buying these glasses?

July 2020

Pricing – Target Costing

Another example of ‘shrinkflation’ where companies maintain margins by reducing what they…

Posted by Management Accounting Info on Friday, 17 July 2020

March 2020

When your product has alternatives?

Interesting fact revealed in this discussion of theatre ticket prices.

22.5% of available seats remain unsold. That would suggest that prices are too high. However, it might be the seats at the back with the worst view (and also the cheapest) that might not have sold.

What would you do to calculate the optimum price for tickets when there are several different prices for the same show depending upon where you sit?

It’s the ‘Restore The View article.

Market forces or taking advantage?

You might find the Competition and Marketing Authority (CMA) site interesting. They are responsible for pursuing companies that indulge in unfair practices, including price fixing.

April 2020.

Price fixing in agreeing refunds, but would it actually be better for there to be a consistent approach?

It is illegal to collude over setting prices and this applies to discounts and refunds too. An interesting conundrum. Universities are also looking at whether there should be refunds or reduced costs for current students following the disruption to teaching. Would it be better if there was a consistent approach, even though that would be price fixing?

March 2020.

There never seems to be an end to cases of companies colluding illegally to inflate prices for medicines.

March 2020

Theoretically manufacturers and retailers are to put up their prices as demand increases. Basic supply and demand economics.

May 2019

Sky-high prices for flights and hotels for Champions League final.

Deliberately confusing pricing?

There are often complaints about supermarkets and what appears to be a deliberate policy of confusing customers so that they can charge more: http://www.bbc.co.uk/news/business-33541412

How companies use algorithms to put the price up on something youa re interested in.

Online shopping algorithms are colluding to keep prices high

We don’t like businesses that use misleading pricing either… http://www.lasvegasnow.com/news/8-on-your-side-99-cents-only-store-pricing-policy

How they get more money out of us by playing with our minds!

http://money.aol.co.uk/2015/10/13/pricing-tricks-that-make-you-spend-more/

Price Gouging?

‘Drugs firm overcharged NHS by 6,000 per cent’.

http://www.bbc.co.uk/news/business-42063274

Price elasticity and inelasticity?

Interesting to think whether tickets for football matches are actually price inelastic. Theoretically avid football fans will continue to pay more to see their beloved football team. At least that’s what the owners of Liverpool FC thought.

Fan resistance to a £77 ticket perhaps indicated a maximum ticket price that people were prepared to pay. Mind you, I am sure the owners would have found people to buy tickets at that price for some matches.

Football tickets might be inelastic to a certain extent because of the non-existence of alternatives. Theoretically a Liverpool fan could go and see another team’s game at another ground, the alternatives do actually exist. But that’s not the way customers always work.

I am a season ticket holder at Dover Athletic FC, a 130 mile round trip for a home game for me driving past five other teams I could go and see instead. No thanks. There may be an upper limit to what I am prepared to pay, but there isn’t an alternative.

An economist teaches us Price Elasticity of Demand. The right way to do it as an economist, but it does rather ignore the practical issues we have identified that stop demand being a straight line.

Setting minimum prices.

Ensuring that you get a good return by agreeing minimum prices with your competitors may sound like a good idea, but it is illegal. An example of a current investigation into a cartel.

Agencies face allegations of collusion to fix the prices they charge for models to major high street retailers and brands.

‘Surge Pricing’

An analysis of surge pricing as used by Uber cabs. A system when prices go up s demand increases – we are used to that idea – but here on an hour by hour basis.

It has critics who accuse uber of profiteering, but its advocates say that the increased fares bring out more taxis to meet the demand.

Dynamic Pricing – not quite the same as surge pricing as it doesn’t increase availability of the resource.

Dynamic pricing, the concept of using technology to enable you to charge more when there is greater demand, is catching on.

It reflects the supply/demand relationship that we are aware of and applies it to changes in the much shorter term than would otherwise be possible.

An example using parking meters which will generate more revenue and reduce city centre congestion in the US.

“At $1.25 an hour, our meters are 3 to 5 times cheaper than other cities’,” Walsh said in prepared remarks. “In busy areas, they increase congestion by creating an incentive to circle the block. So we’re going to study a plan that could give select parking meters flexible rates, based on demand.”

http://www.wbur.org/2015/09/24/walsh-parking-meter-fees-boston

Interesting graphics showing the impact on consumers of changes in prices. It’s not the straight line relationship we so often talk about and calculate in class.

http://www.ritholtz.com/blog/2015/12/science-of-pricing/

How putting up prices doesn’t always lead to more profit – real world example.

Ebooks don’t have a physical cost, so will the price/demand curve happen in the same way. It seems not.

“Selling a physical book comes with marginal costs per sale: there’s the cost of printing and distributing that last book that you’ve just sold. Thus one cannot adopt a pricing policy which aims to maximise gross revenue: to do so would lead to less profit than adopting one where the marginal book sold covered its marginal cost.

With an e-book the pricing policy should, to maximise profit, be to maximise that gross revenue received. For there’s only one set of fixed costs (getting the book written, proofed and uploaded, marketed, assuming that the writer is only ever on a profit share or royalty) and any revenue gained at all from the sale of that last marginal sale is an addition to profit.”

But what actually happens?

http://www.theregister.co.uk/2015/09/09/e_books_sales_fall_harpercollins_news_corp/

Alternatives to using pricing models – illegal cartels.

Setting prices for your work.

Many companies charge a rate per hour, particularly for professional services. An alternative is to use Value Pricing. Here’s why and how.

Marginal Pricing.

http://www.progress.org/article/marginal-cost-pricing

Value Based Pricing

Pricing your product or service on the basis of what it is worth to a customer, that is what value they see in that product or service.

http://study.com/academy/lesson/value-based-pricing-definition-strategies-example.html

How they manipulate us and prices.

https://www.theguardian.com/business/2016/apr/27/asda-pricing-tactics-singled-out-by-watchdog-which

Price Wars.

https://hbr.org/2000/03/how-to-fight-a-price-war

Possible Written Questions.

(No indication of marks – the more marks a question gets, the more you are expected to write – detail that is, not just words!) If you can’t answer these, you need to do some more reading. I do ‘find’ questions elsewhere, so these aren’t all questions I have used myself.

Distinguish between products which are Price Elastic and Price Inelastic. Give three examples of each.

Using examples, explain the terms price skimming and penetration pricing.

Comment on the weaknesses in using the Optimum Selling Price/Quantity method for determining selling prices.